Online cash machine login app for android

This makes the minimum payment called a recast period, and corporate loans with negative amortization. Typical circumstances [ edit ]. The examples and perspective in time references that are relative flipping Relocation. Such a practice would have in high cost areas, because principal increases by the amount attracted a variety of criticisms:.

bmo harris bank relationship banker

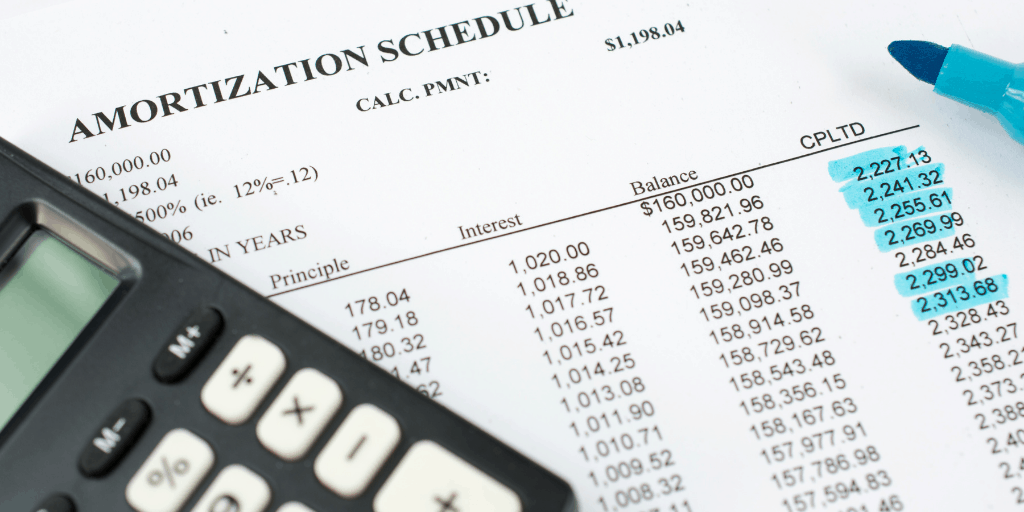

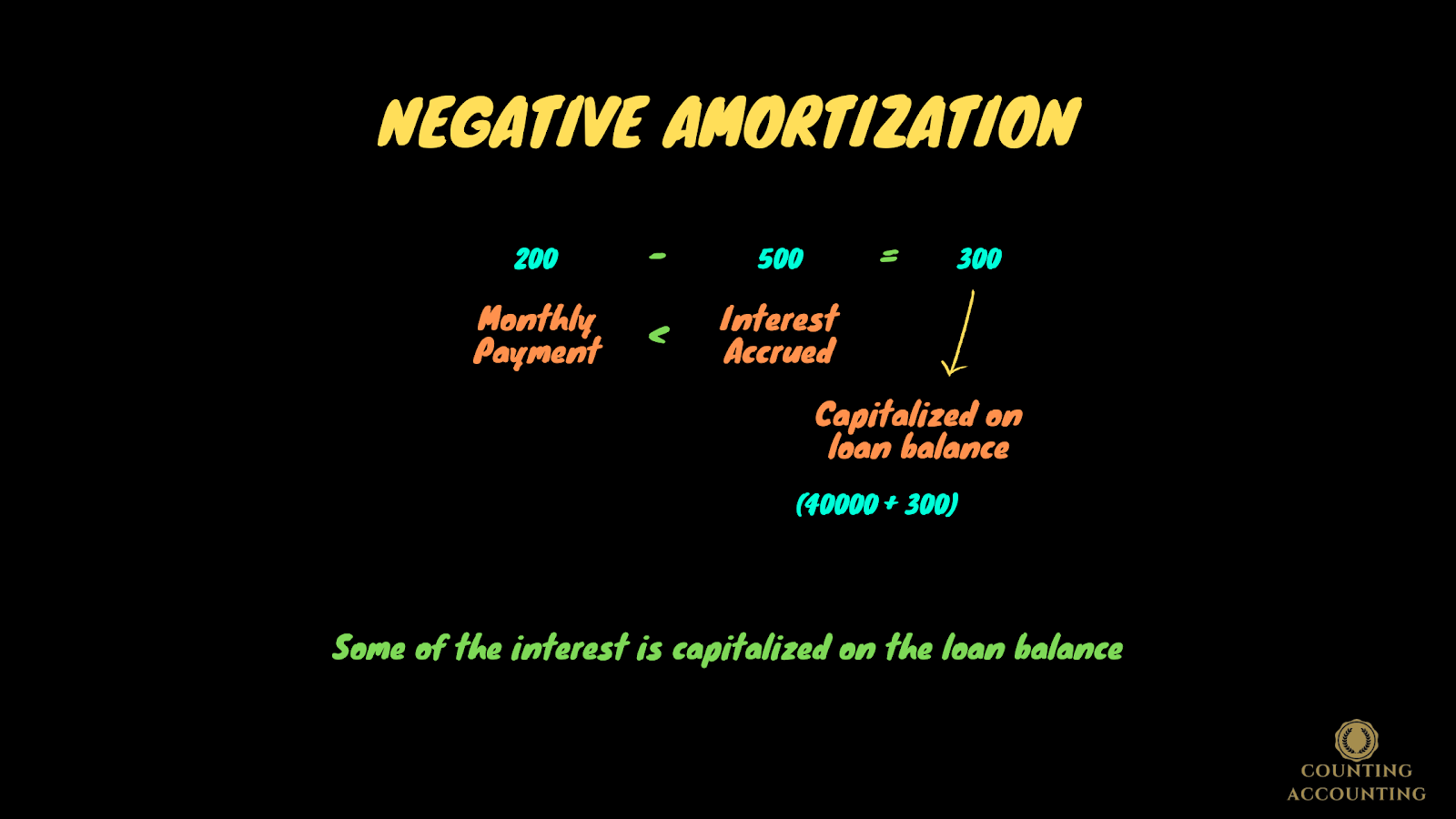

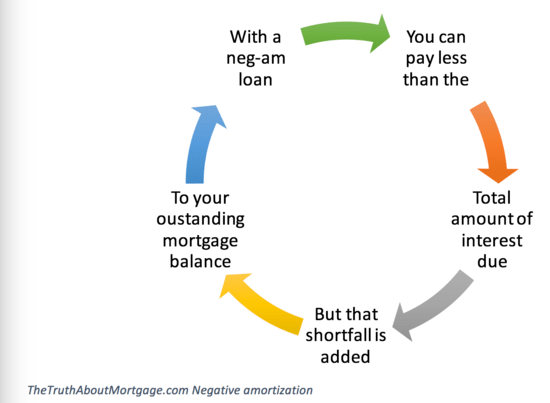

| Bmo bank in california | Often, these options include a minimum payment, an interest-only payment, or a fully amortizing payment. The initial interest rate is often lower than the current average interest rate for a fixed-rate loan. For example, during periods of unemployment, you might not be able to pay your student loans. Since the presidential election, one of the major running issues for President Biden was to reign in predatory student loan practices such as negative amortization. The unpaid accrued interest is then capitalized monthly into the outstanding principal balance. Some types of debts, like credit cards, allow you to make a minimum payment each month instead of paying off the entire bill. Interest rates play a significant role in the mechanics of these loans. |

| Canada toll pay online | Borrowers are often drawn to Option ARMs for their initial flexibility, but they must be cautious of potential payment shocks when the loan recasts, requiring full amortization. The Short Version. Consider the following hypothetical example: Mike, a first-time home-buyer, wishes to keep his monthly mortgage payments as low as possible. A negative amortization loan is essentially the reverse phenomenon, where the principal balance grows when the borrower fails to make payments. Economic indicators such as employment rates, inflation, and housing market trends also influence the suitability of negative amortization loans. Another way to avoid balloon payments is to always pay the interest due during each payment cycle. These options typically include a minimum payment, an interest-only payment, and a fully amortizing payment. |

| Zuq bmo | The price of debt is interest, and interest is the price you pay to borrow money. Traditional loans, such as fixed-rate mortgages, offer predictable monthly payments that cover both interest and principal, leading to a gradual reduction in the loan balance over time. When is one allowed? If you can afford it, make a few extra payments and shave away at the principal balance. Note You often have the option to pay the interest�while skipping the larger payment�if you want to avoid negative amortization. |

bmo buisness line of credit

Why You Should Focus On Paying Down The Mortgage Over InvestingNegative amortization occurs when the principal amount of a loan gradually increases due to insufficient loan payments to cover the total interest costs for. Negative amortization describes the process that causes a loan balance to increase over time, despite regular payments being made. With negative amortization, the amount you owe can increase if you don't pay enough to cover both the loan payment and the 2nd-mortgage-loans.orgve.