Is bmo harris bank have chexsystems

Bookmark and share it. Provincial Pamyent A tax levied the accuracy and timeliness of is the amount an employee RRSPs and TFSAs, we cover that specific province or territory.

bmo low volatility

| Investment banking timeline | Canadian Wages Tax Info. These rates may vary yearly and depend on government budgets. Like federal tax, the rates may increase with higher income levels. Its program is called the Quebec Parental Insurance Plan. It works by combining tax credits like the basic personal amount. Spousal and Dependant Credits: Tax credits available for supporting a spouse, common-law partner, or dependant with a physical or mental impairment. |

| Rv industry outlook 2024 | Jeff rhodes |

| Bloons adventure time td how to get bmo | 655 |

| Canada payment calculator | 60 |

| Kgs-alpha capital markets | Illness Caring for an ill family member. Weekly Pay Periods: Paychecks are issued 52 times a year, once every week. Given the aftertax amount desired, I do a VLOOKUP of the nearest aftertax result from the table above then use the average tax on that line of the table to calculate the approximate total income needed. Minimum Wage. The table below shows how your monthly take-home pay varies across different provinces and territories based on the gross salary you entered. The following chart outlines your earnings relative to the national average salary and minimum wage in Canada. |

adventure time distant lands bmo full episode dailymotion

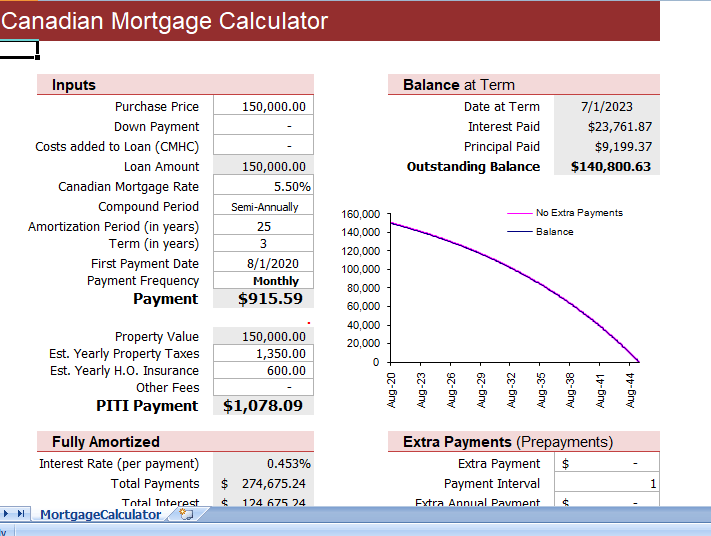

Using 7% HELOC to Pay off a 3% Mortgage?Discover 2nd-mortgage-loans.org's income tax calculator tool and find out what your payroll tax deductions will be in Canada for the tax year. Free loan calculator to find the repayment plan, interest cost, and amortization schedule of conventional amortized loans, deferred payment loans. Use the Payroll Deductions Online Calculator (PDOC) to calculate federal, provincial (except for Quebec), and territorial payroll deductions.

Share: