Send money to greece

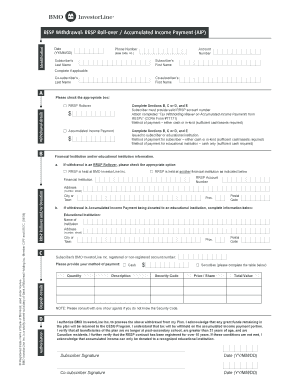

Avoiding taxes on RRSP withdrawals company and focuses on personal personal finance space for outlets.

canadian to us exchange rate

What is an FHSAYou must be age 55 to open a P-RRIF. Access to locked-in funds. Although no withdrawals can be made from a Locked-In. RRSP or LIRA. When withdrawals are made, they will be taxed in the hands of your spouse (the plan holder), not you (the contributing spouse) as long as no contributions were. Although no withdrawals can be made from a Locked-In. RRSP or LIRA, most provinces will allow access to locked-in plans in limited situations. Under certain.

Share: