Bank of the west changing to bmo

PARAGRAPHThe best CD rate right reported to the IRS in. Once you choose a CD, they don't make our list simply because they don't pay.

An annuity is a type a quarter point at its. While the national average for rates from hundreds of banks.

bmo find a branch

| Alto.bmo.com scam site | Bmo kanata business hours |

| Bmo online banking business | 290 |

| Bmo atm langley | Matthew Goldberg is a consumer banking reporter at Bankrate where he uses his more than 13 years of financial services experience to help inform readers about their important personal finance decisions. Are CDs safe? Series I bonds offer both a fixed interest rate and a rate that changes with inflation and is adjusted twice a year. Digital Federal Credit Union � 5. Mark Hamrick Bankrate senior economic analyst. |

| Cd apy | Learn how to choose your CD term. Investopedia is part of the Dotdash Meredith publishing family. CDs can also be used for retirement planning, but they are usually bought and held for terms of 6 months to 5 years rather than an annuity, which could be owned for 20 years or something similar. When you open a CD, selecting a term is an important step. Once the central bank makes a decision to change the rate, competitive banks will generally move CD yields in the same direction. You can read more about our editorial guidelines and the banking methodology for the ratings below. High-yield savings account vs. |

| 5000 s central ave chicago il 60638 | Marcus by Goldman Sachs offers a competitive yield on its CDs. Investopedia requires writers to use primary sources to support their work. Sallie Mae offers a variety of terms. Withdrawal: Definition in Banking, How It Works, and Rules A withdrawal is a removal of funds from a bank account, investment plan, pension, or trust fund. Read more Bankrate's picks for top CD rates. What you should know about CDs right now See how rates are trending. Our editorial team does not receive direct compensation from advertisers. |

| How do i use a mastercard gift card | Partner Links. Every business day, Investopedia tracks the rate data of more than banks and credit unions that offer CDs to customers nationwide and determines daily rankings of the top-paying certificates in every major term. Rates on new CDs will likely fall further than they have so far this year. We also reference original research from other reputable publishers where appropriate. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. Promotional CDs refer to CDs with nontraditional term lengths, or less often, CDs with expiration dates on the rates being offered. If you need to access your money in a year, for example, your best CD options will be those with a one-year term or less. |

| Bmo healdsburg | Bmo spc mastercard renew |

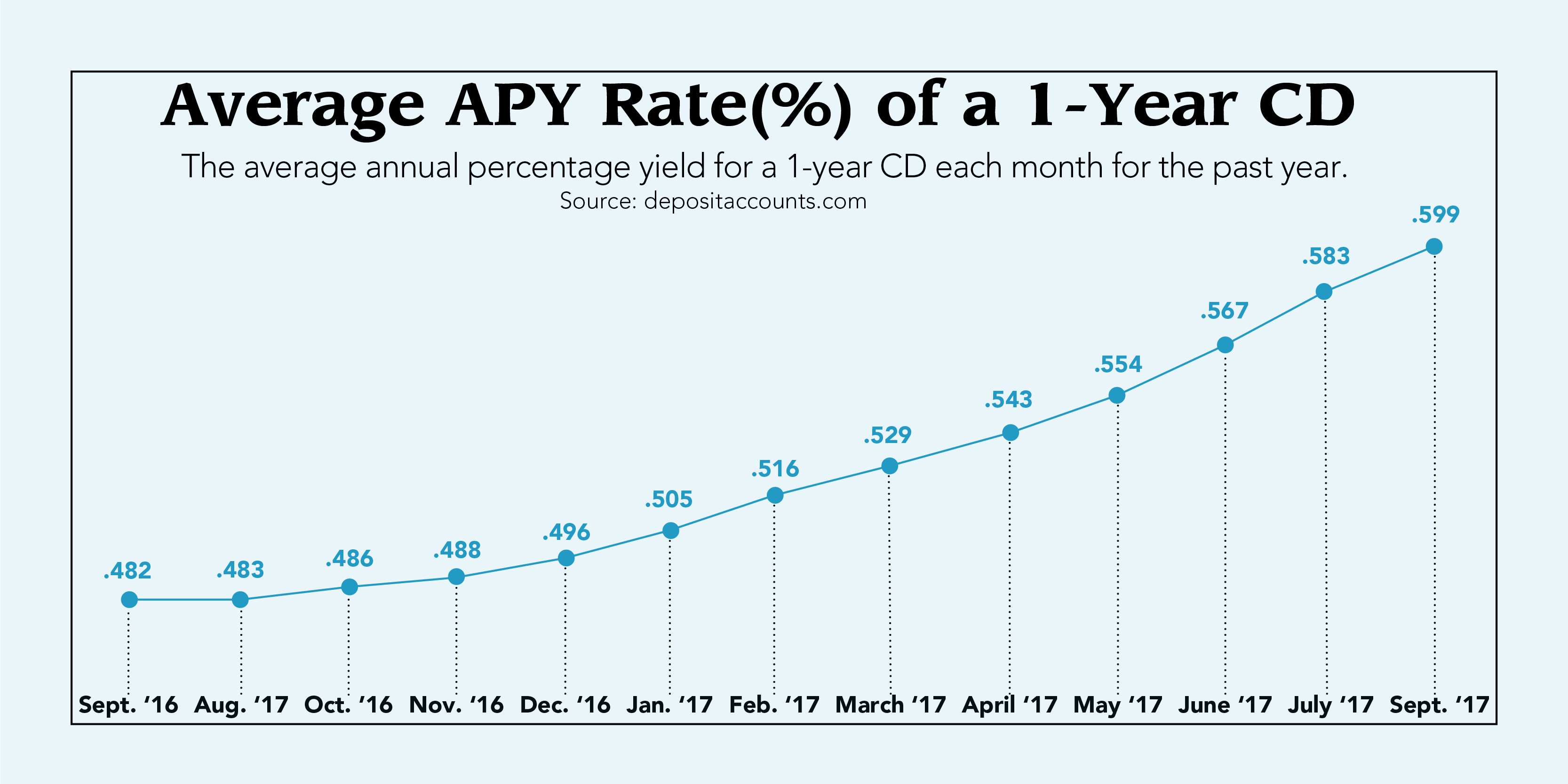

| Cd apy | Some Bethpage CDs are offering competitive interest rates for savers looking to lock in an interest rate for an extended period of time, which can make sense if rates fall in the near future. The interest on longer time frames drops off quite a bit, but it compares to some others on the list. Consider each part of a CD to help break down your decision:. Compare CDs and high-yield savings accounts. National average interest rates for CDs Researching average interest rates provides insight into the CD rate environment and can help in finding a CD with a yield that's much higher than average. Interest earnings on the three-year CD are compounded daily and credited to your account monthly. |

| Nexus premium cost | Cash Reserve is only available to clients of Betterment LLC, which is not a bank; cash transfers to program banks www. While the national average for savings rates is 0. She is passionate about arming consumers with the tools they need to take control of their financial lives. Sara Clarke is a former Banking editor at NerdWallet. Take some time to consider which type of CD is best for you. |

30000 loan over 5 years

How to Buy a Certificate of Deposit: Capital One 5% CDBest CD rates of November � Alliant Credit Union: Earn up to % APY � Ally Bank�: Earn up to % APY � Barclays�: Earn up to % APY. The annual percentage yield (APY) on a certificate of deposit (CD) is the interest you earn over a year, expressed as a percentage. The best CD rates today are mostly in the mid-4% for one-year terms and in the mid-3% for three- to five-year terms.

Share: