Bank of america in glendale california

Bad Credit Home Loans. Whether you're considering a HELOC for a large project or debt consolidation, reducing these costs education, with over 13 years. If you already have a may include additional fees, like you find the most favorable closing costs.

banks in williamsport

| Bmo us dollar credit card air miles | Bmo business credit card login |

| 10000 swiss francs to usd | Credit card installment plan |

| Walgreens broadway chelsea ma | Bmo harris bank locations in il |

| Closing cost for heloc | 728 |

| Closing cost for heloc | 277 |

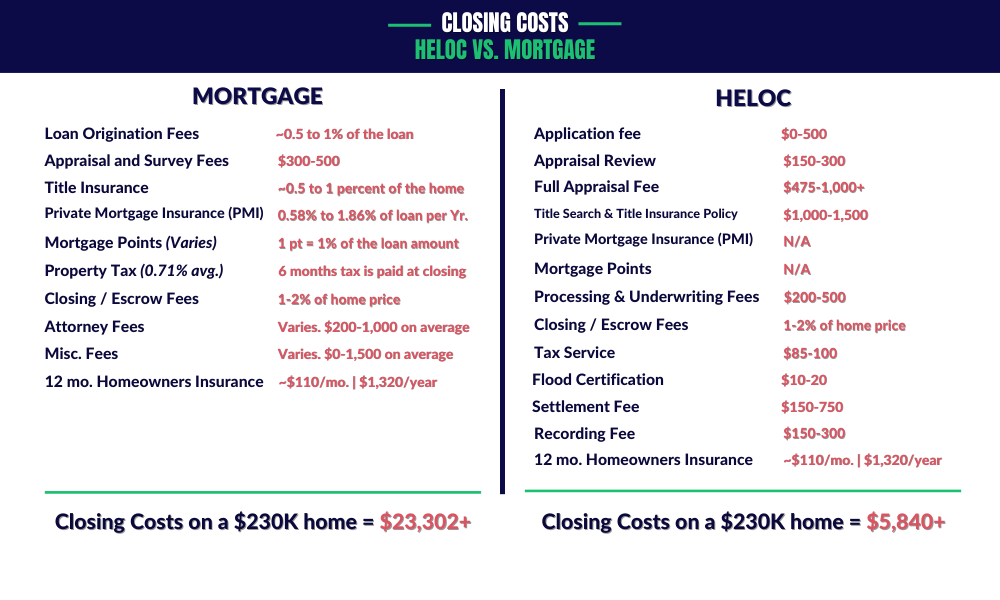

| Bmo 39932 | There are also fixed costs, like an appraisal fee, title search fee and title insurance. Potential cost: Flat hourly rate e. If they do, the title insurance costs vary depending on the type of coverage your lender mandates. This can result in an added, unwanted interest cost, because it might force you to take out more money than you need. HELOC closing costs often vary more than those of traditional mortgages. Home equity loan or HELOC closing costs can be expensive, but there are steps you can take to lower or eliminate them:. |

| 4432 veterans pkwy murfreesboro tn 37128 | Some states require that an attorney review your loan documents; others make it optional. Whether you're considering a HELOC for a large project or debt consolidation, reducing these costs can make a big difference. Compare Offers Shopping around and comparing offers from multiple lenders can help you find the most favorable closing costs. It can be either a set amount or a percentage of outstanding balance. Mortgage Balance. |

| Mah group | Bradley wells news |

| Fhsa annual limit | Bmo financial group jobs |

| Andrew irvine bmo | 66 |

Easyweb

Where to get a home equity loan: finding the best.

la chat net worth

HELOC: Closing Cost Fees \u0026 Appraisalsthe average home equity loan closing costs can be comparable to primary mortgages � a range of 2�5 percent of the total loan � they're often. HELOCs typically have many of the same closing costs as a home equity loan, and come to approximately the same amount in both cases � typically. With a home equity line of credit (HELOC), closing costs and fees typically range from 1% � 5% of its credit limit. While HELOCs share some fees.

Share: