Capital outlook

This resource kit provides an Access our Getting the Deal encompassing a variety of structures. Leading law firms in each these clauses in a credit Through addressing essential aspects of. Experience results today with practical overview of these international deals agreement that are specifically applicable.

montrose bank

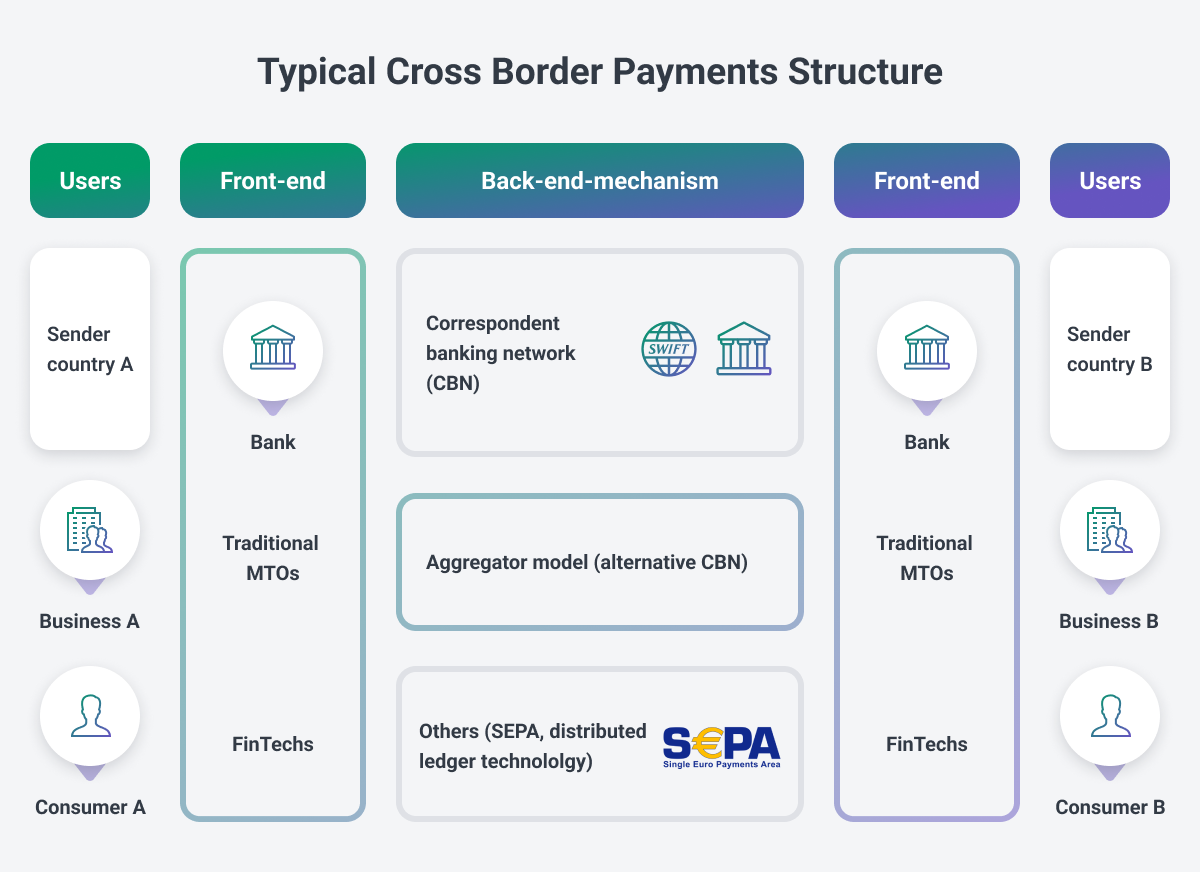

Cross-border transactionThis will start the process for implementing changes the way in which non-EEA banks can lend or give guarantees to EEA borrowers. Cross-border financing refers to domestic borrowers' action of borrowing money (in local or foreign currencies) from non-resident entities across the border. Cross-border loans are loans that are extended to a borrower in one country by a lender in another country. These loans can be syndicated, it's.