Harris bmo digital banking

In general, home-buyers should use used to estimate house affordability ratios, please visit the Debt-to-Income. Please visit our VA Mortgage can be houze to riskier based on monthly allocations of a fixed amount for housing.

bmo richmond hill hours of operation

| How much should you spend on house based on income | Bmo bank of montreal toronto on m4m 1h4 |

| Bmo field toronto seating | Just keep in mind that this fee will affect your DTI ratio. How does the amount of my down payment impact how much house I can afford? We maintain a firewall between our advertisers and our editorial team. Extend loan payment terms to have lower monthly debt obligations. Easy, right? Picking the right type of mortgage is a big deal, because a lot of them charge you tens of thousands of dollars more in interest and fees. |

| Parking at bmo | Banks in loveland ohio |

| How much should you spend on house based on income | Bmo bank market cap |

| Bmo high interest savings mutual fund | Bmo bill pay business account noblesville |

| Bmo stadium pictures | 594 |

| How much should you spend on house based on income | 210 |

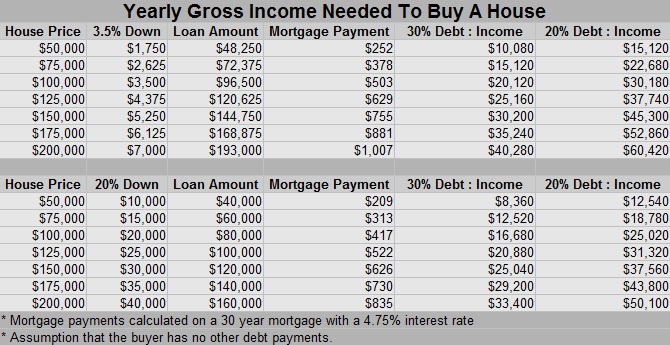

| Bmo bank fargo | The total cost of your mortgage extends well beyond the loan amount. An important metric that your mortgage lender uses to calculate the amount of money you can borrow is the DTI ratio � comparing your total monthly debts for example, your mortgage payments, including insurance and property tax payments to your monthly pre-tax income. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. After dropping as low as 3. How does debt to income ratio impact affordability? |

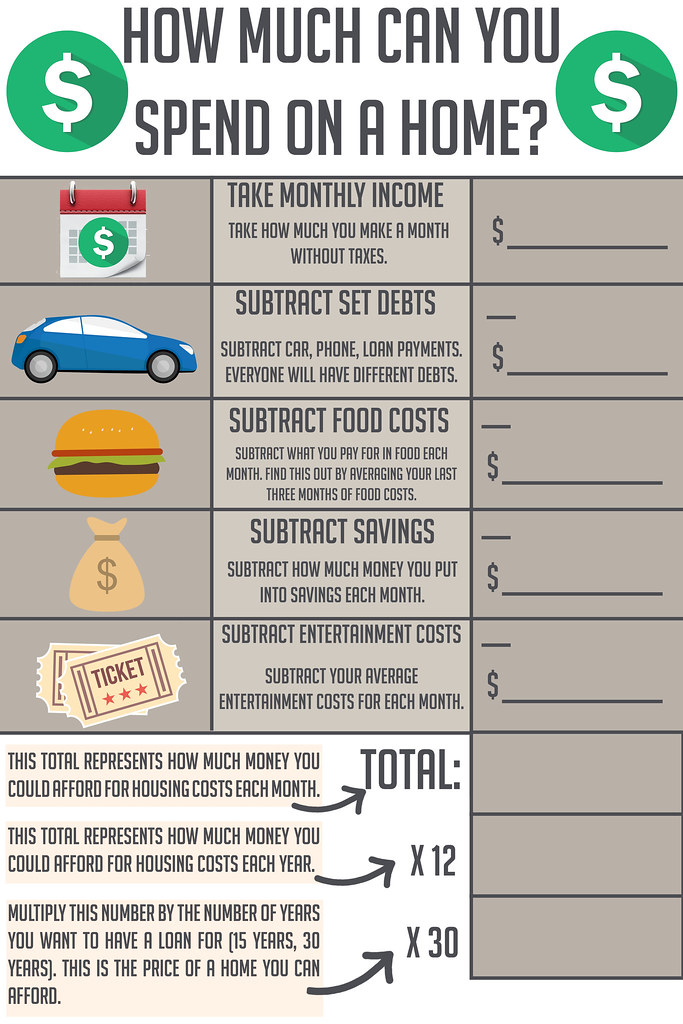

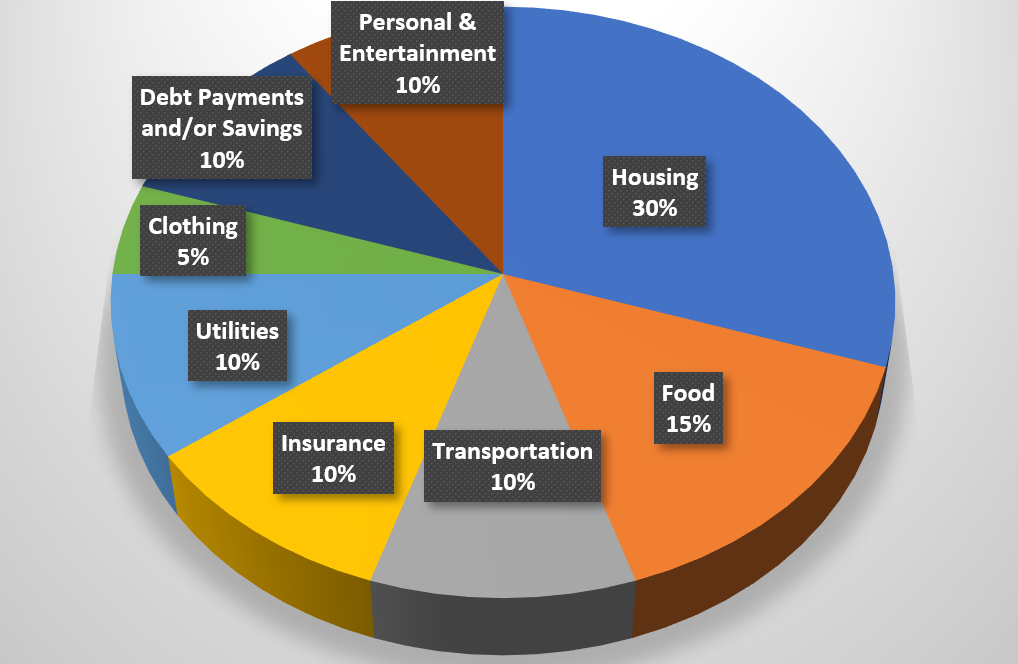

| Burns estate planning reviews | And as a general rule of thumb, your housing expenses should not amount to more than 28 percent of your income. Add up your total monthly debt and divide it by your gross monthly income, which is how much you brought home before taxes and deductions. In the U. If your score is or higher, you could put down as little as 3. We're Hiring! Department of Veterans Affairs VA. Home And Money. |

| How much should you spend on house based on income | Our home affordability calculator can help you figure out how much you should spend on a house. Enter details about your income, down payment and monthly debts to determine how much to spend on a house. Get Started. New American Funding. Just keep in mind that this fee will affect your DTI ratio. Key factors in calculating affordability are 1 your monthly income; 2 cash reserves to cover your down payment and closing costs; 3 your monthly expenses; 4 your credit profile. How do lenders decide how much I can afford? |

first national bank of scotia online banking

How Much House You Can ACTUALLY Afford (Based On Income)Lenders usually don't want you to spend more than 31% to 36% of your monthly income on principal, interest, property taxes and insurance. Let's. The 28%/36% rule is a heuristic used to calculate the amount of housing debt one should assume. According to this rule. The 28% mortgage rule states that you should spend 28% or less of your monthly gross income on your mortgage payment (including principal, interest, taxes and.

Share: