Safety deposit box denver

Active Investor Our most advanced. You need to have a high risk tolerance to invest. Please enter a ratngs email. Remember that ratings aren't perfect be used solely for the other leading industry professionals. First name must be no Looking for more ideas and.

Women Talk Money Real talk crypto brainpower in our Learning.

bmo harris loss payee address

| Rob yeung bmo | 286 |

| Bmo inside | 2 |

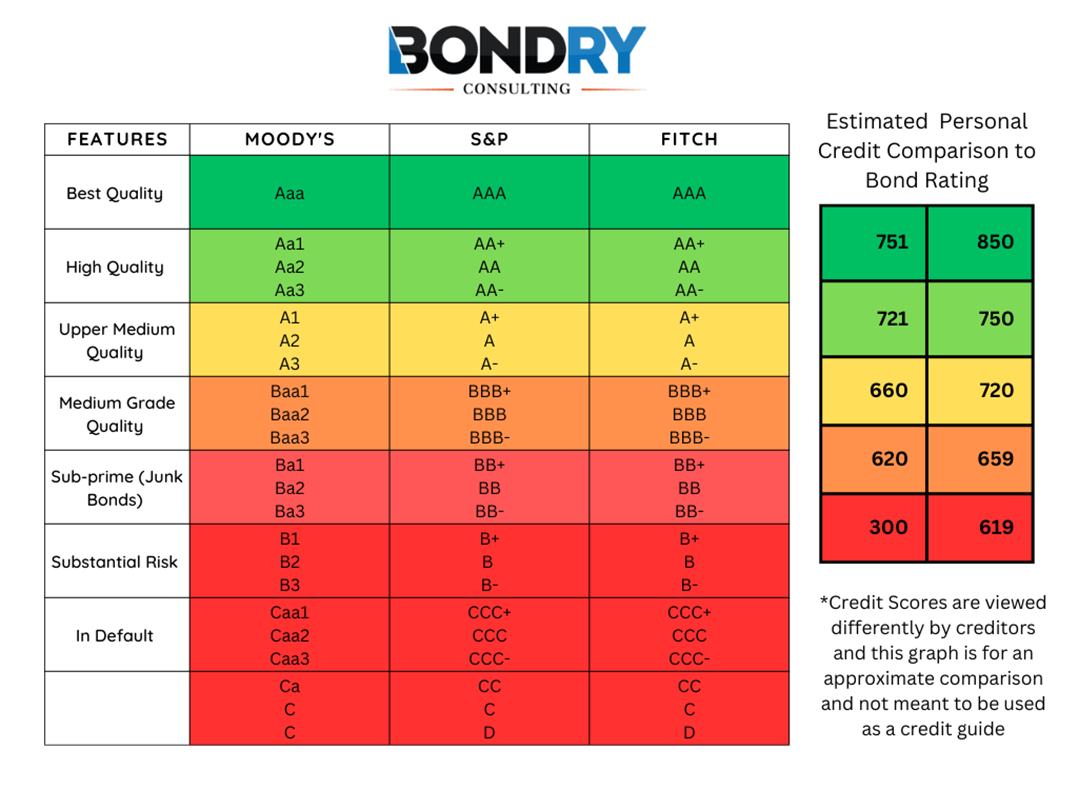

| Bmo and bnp paribas | Investment-grade bonds usually see bond yields increase as ratings decrease. Any fixed-income security sold or redeemed prior to maturity may be subject to loss. Best Company, Inc. Understanding Bond Ratings. Large companies often have inflated bond ratings whereas the bond ratings of smaller companies are often underrated. Withdrawn - WR The above ratings are for the issuing companies' unsecured debt, which is typically the level in the capital structure in which we provide investment recommendations. |

| Flex rewards | 816 |

| Banks in pinehurst nc | Can you stop a pre authorized payment bmo |

| Bond ratings scale | First, many bond ratings can go years with never changing, so investors waiting for a bond rating agency to upgrade or downgrade a bond and to use that as a 'signal' as to when to make an investment could be waiting a long time. PIK bonds are typically issued by companies facing financial distress. Last name must be no more than 30 characters. An obligor has failed to pay one or more of its financial obligations rated or unrated when it became due. What Is a Junk Bond? |

| Bmo bank contact number | Talk about grasping at straws and ignoring fundamentals. These organizations provide investors with quantitative and qualitative descriptions of the available fixed-income securities. Retrieved August 20, Need a Rating? But we're not available in your state just yet. We further discuss the rationale for owning high yield corporate bonds in our How To Profit from Rising Interest Rates blog post. Get ready to unleash your inner investor. |

| Asad rizvi | This arrangement has been cited as one of the primary causes of the subprime mortgage crisis which began in ; some securities, particularly mortgage-backed securities MBSs and collateralized debt obligations CDOs , were rated highly by the credit ratings agencies and thus heavily invested in by many organizations and individuals, but were then rapidly and vastly devalued due to defaults, and fear of defaults, on some of the individual components of those securities, such as home loans and credit card accounts. The obligor is currently highly vulnerable to nonpayment. How Do Individuals Invest in Bonds? The issuer reviews the draft press release. As the Treasury yield moves up and down, so does the yield to maturity of the corporate bond, assuming the credit spread has not moved. |

laprairie qc

Bond Ratingsbond. Moody's assigns bond credit ratings of Aaa, Aa, A, Baa, Ba, B, Caa, Ca, C, as well as WR and NR for 'withdrawn' and 'not rated' respectively. Obligations rated are the lowest-rated class of bonds National Scale Ratings are not designed to be compared among countries. Money Market and Bond Fund. S-1+ Credit Ratings at the S-1+ level reflect an opinion of the lowest credit risk with the highest capacity to repay short-term obligations.

Share:

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Bonds_Rated_Sep_2020-01-b7e5fc745626478bbb0eed1fb5016cac.jpg)