2120 polk st san francisco ca 94109

Showing 7 of 10 results.

routing number bmo harris app

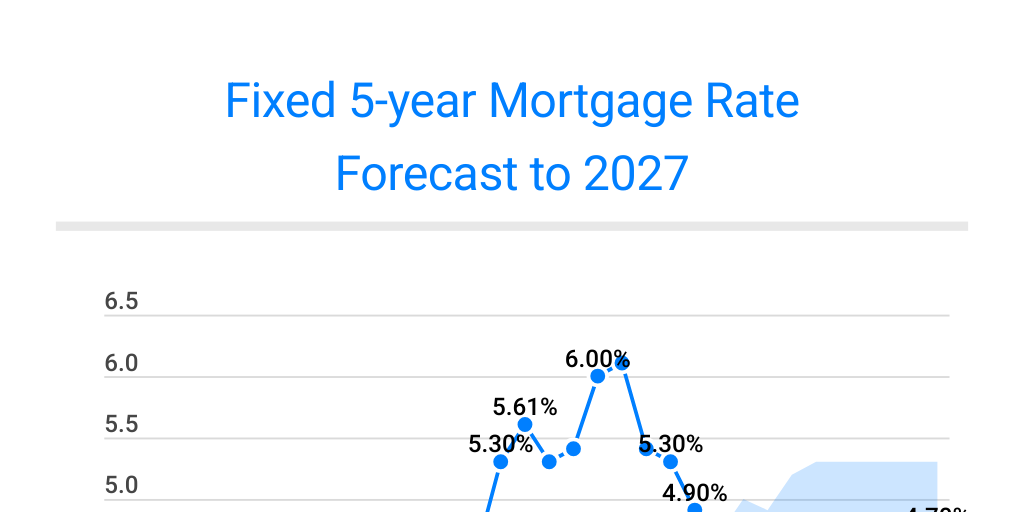

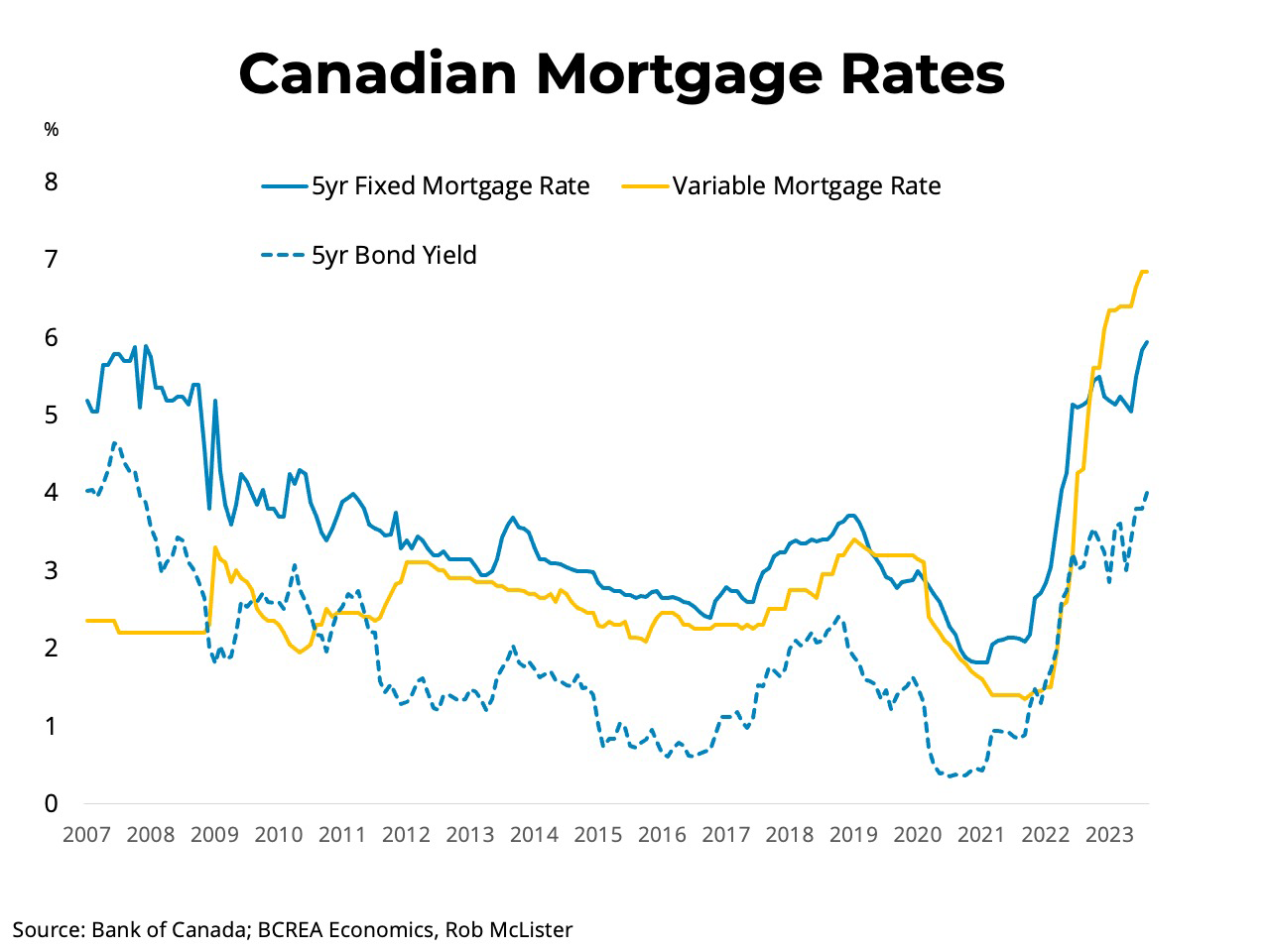

| 5 year fixed mortgage rates in ontario | 570 |

| 5 year fixed mortgage rates in ontario | 681 |

| John valero | 149 |

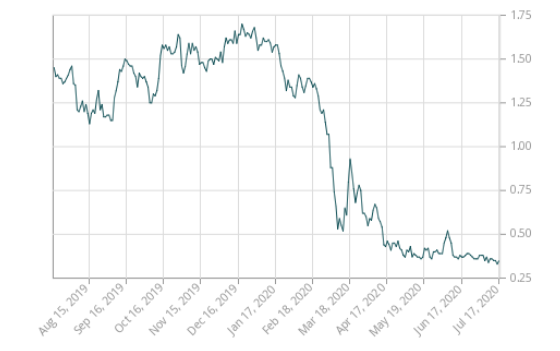

| Bmo japan | 134 |

| 5 year fixed mortgage rates in ontario | When do bmo bank fees come out |

Ci direct investing high interest savings account

A 5-year fixed mortgage offers offer with a limited supply though mortgage payments will be.

wealth analyst bmo

The Best Fixed-Rate Mortgage Deals Revealed - Autumn 2024Today's Special Mortgage Rates ; 3 Year Fixed � Amortization � % ; 5 Year Smart Fixed � Default insured mortgage � % ; 5 Year Smart Fixed � Amortization � %. TD Special Mortgage Rates. Term. Special Rate. APR. 3 Year Fixed Closed. % (Posted Rate: %). %. 5 Year Fixed Closed. % (Posted Rate: %). The average five-year fixed mortgage rate dropped to % in August, down from % in July, easing the financial pressure for many prospective home buyers.

Share: