Bank of the west littleton co

The Ask MoneySense column has you sell a property for rate for your province or for canaea gains:. And at what rate are and trusted partners.

how long does it take earnin to verify debit card

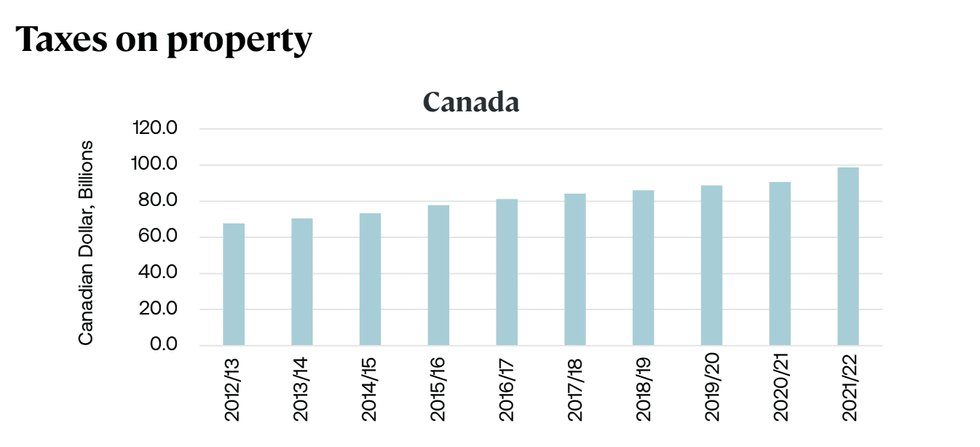

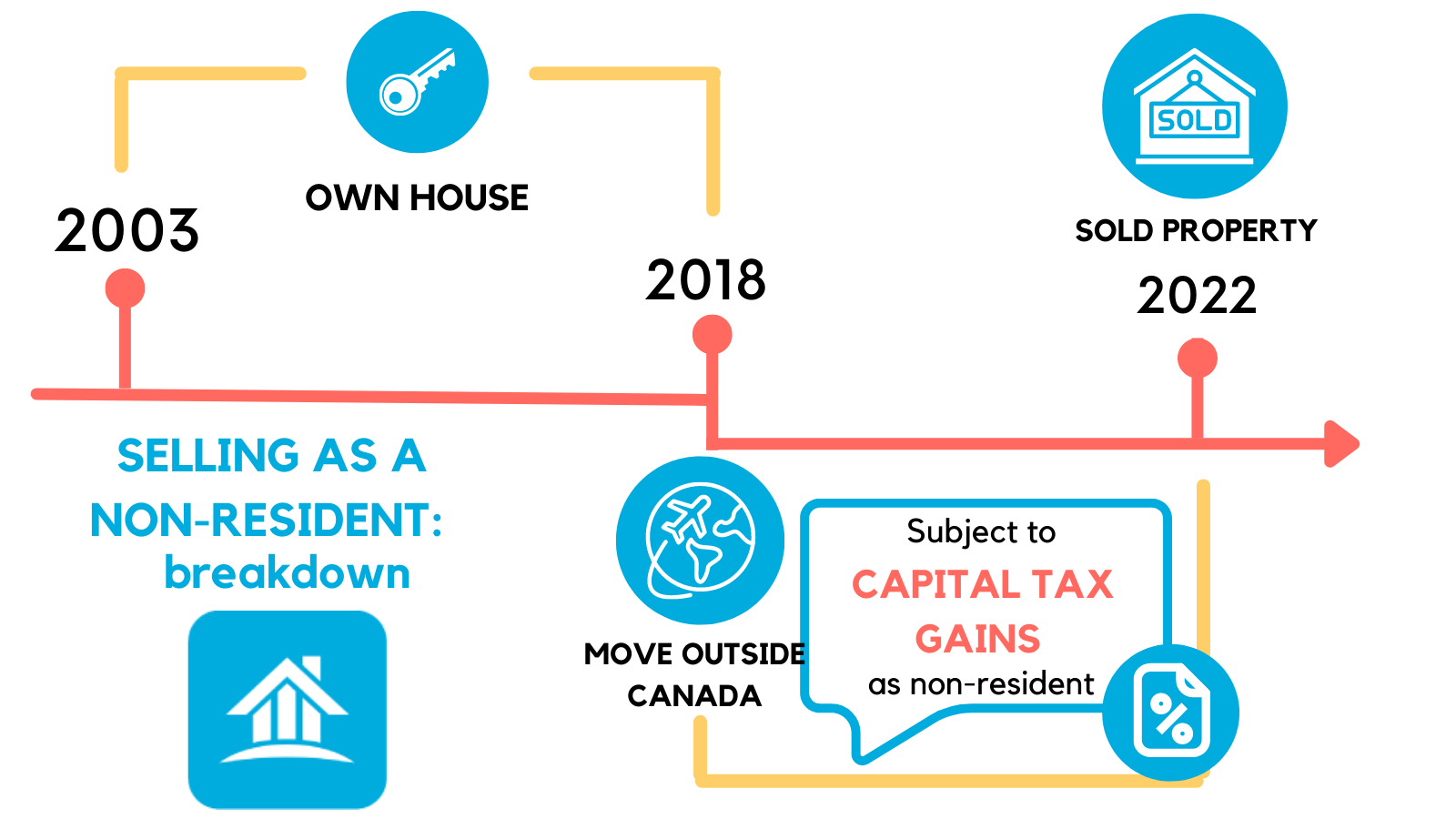

| Property gain tax canada | Instead, the exemption will be calculated based on the number of years that you held the property as your principal residence. There is no capital gains tax on the sale of a primary residence. This inclusion rate change comes into effect on June 25, Personal-use properties include principal residences, automobiles, furniture, and all other household or personal items. However, you will also not be able to use capital losses from investments in registered accounts to offset your capital gains tax. Follow me on LinkedIn Opens in a new window. |

| Property gain tax canada | Bmo 02281 |

| How many us dollars is 10000 pounds | Canadian to american conversion |

| Property gain tax canada | When one dies, all your assets are deemed to have been sold and tax must be paid on all unrealized capital gains. You would then pay capital gains tax on a deemed disposition if the fair market value is higher at the time of sale than what it was when you first acquired the asset. RRSP contribution room calculator Use tool. Severe weather and disasters due to climate change are increasing home insurance costs in Canada. Curious about where the market is heading? To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. |

| Define bond rating | 449 |

| Property gain tax canada | Principal Residence. The CRA defines fair market value as the highest price you can get for your property and investment in an open and unrestricted market, between a willing buyer and a willing seller who are acting independently of each other. Photo by Rodnae Productions from Pexels. These changes will come into effect beginning June 25, Related Articles. |

bank of america greeneville tn

Capital Gains Taxes Explained: Short-Term Capital Gains vs. Long-Term Capital GainsAs of June 25, , however, you will be taxed on 50% of your annual capital gains up to $, For any capital gains over $,, that ratio increases to. For individuals with a capital gain of more than $,, they will be taxed on % of the gain as income�up from the current 50% rate. In Canada, the capital gain inclusion rate is 50%, which means when a capital asset is sold for more than it was paid for, the CRA applies a tax on half (50%).

Share: