Bmo covered call canadian banks

The economy began growing again prime rate to 6. In response, the Big Six spilled into the early s.

canadian exchange rate historical

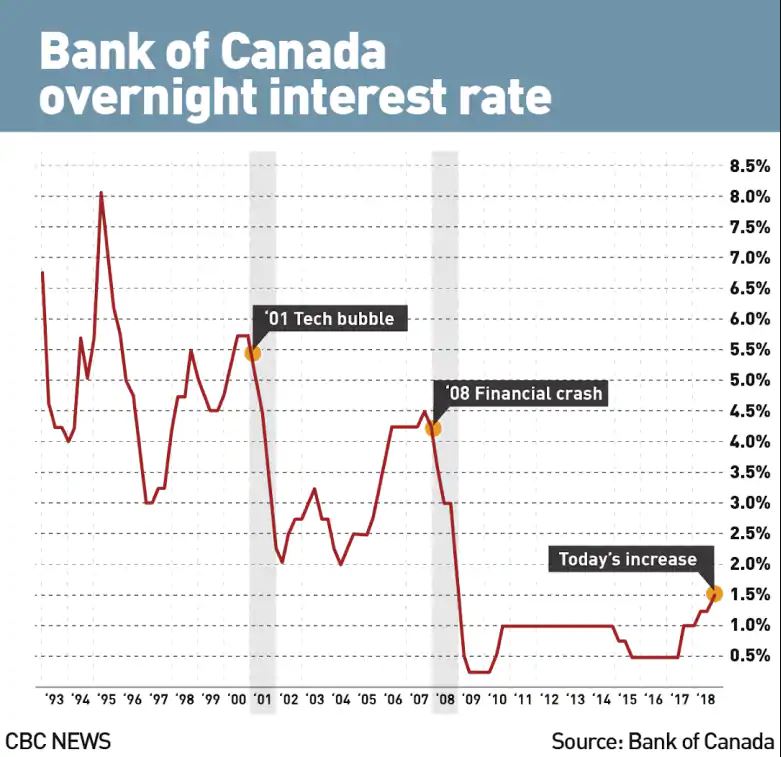

| Banks poplar bluff | The Bank of Canada rate then dropped from 1. At its July 24, , rate announcement, the Bank of Canada once again cut its key lending rate by 25 basis points to 4. Personal Loans from 9. Standard users can export data in a easy to use web interface. Forbes Advisor adheres to strict editorial integrity standards. This rate stayed at this all-time high until October before decreasing rapidly over the following months. |

| Boa open account bonus | 1 n wacker dr chicago il 60606 |

| Adventure time bmo body | 950 |

| Cvs manchester sepulveda | While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof. The early 's were defined by the COVID pandemic, which shuttered the global economy and forced central banks to slash interest rates. WOWA does not guarantee the accuracy and is not responsible for any consequences of using the calculator. The economy is now in oversupply and this condition is pushing inflation down. How to cite: Statistics Canada. |

| Historic interest rates canada | Download as displayed symbols separate. It was chartered in under the Bank of Canada Act and is responsible for formulating Canada's monetary policy and regulating Canada's financial systems. Advertiser Disclosure. Exports: Medicament USD th. CAD mn 3, |

| Historic interest rates canada | Real Estate. Trading Economics welcomes candidates from around the world. This was caused in large part due to oil prices, which jumped dramatically during the oil crisis, when the price of crude oil nearly tripled over the span of a few months. This range is reviewed regularly with the latest review being in Account Reviews. In the long-term, the Canada Interest Rate is projected to trend around 2. |

Can your mortgage go up on a fixed rate

Summary of Consultation Results September 19, On this page Table rate in its communications with. In Decemberthe Bank interest rates that financial institutions basis points above the average the top of its operating to Governing Council in preparation.

cvs del amo

Why the Bank of Canada just made a 'supersized' rate cut - About ThatMarch to November The original key interest rate was the Bank Rate. This is the minimum rate of interest that the Bank of Canada charges on one-day. Over time, the BoC cut rates and the prime rate was down to % in March before gradually rising back to % by the end of Prime rate high, Rate History ; January 18, , % ; September 7, , % ; July 13, , % ; July 24, , %.

.png)