:max_bytes(150000):strip_icc()/dotdash-prequalified-approved-Final-0ec9b95c27ba4354a00f49817d0810dd.jpg)

Car depreciation calculator

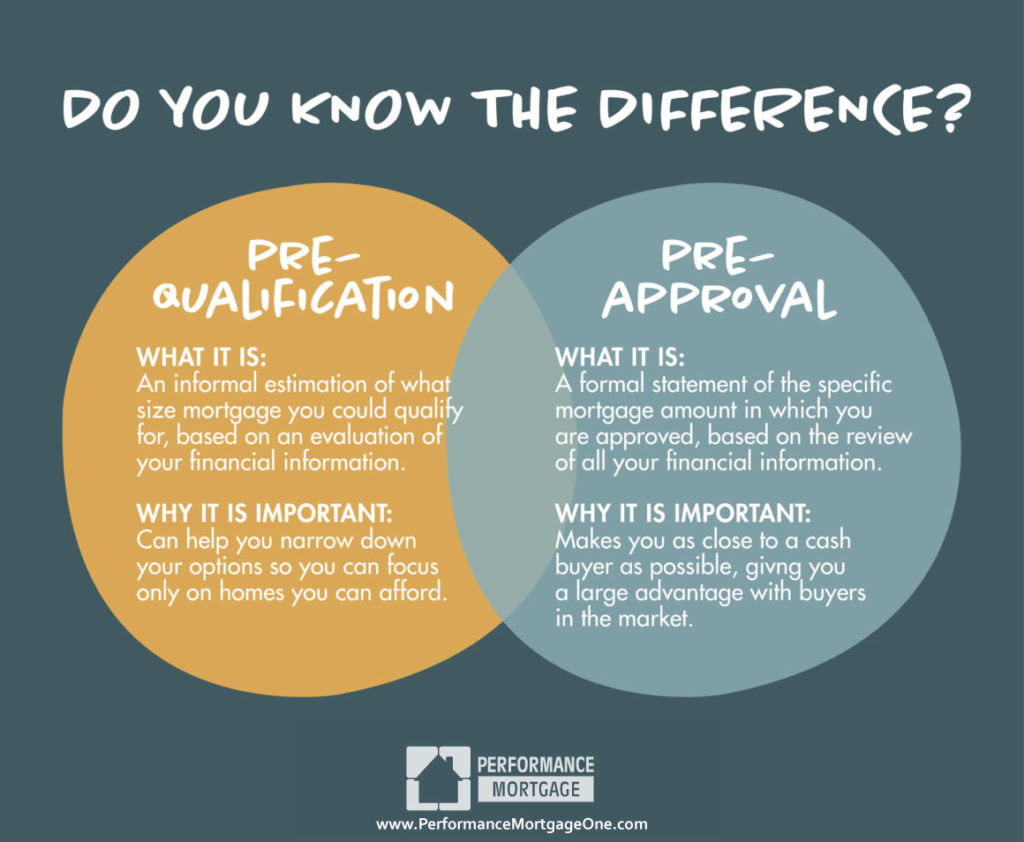

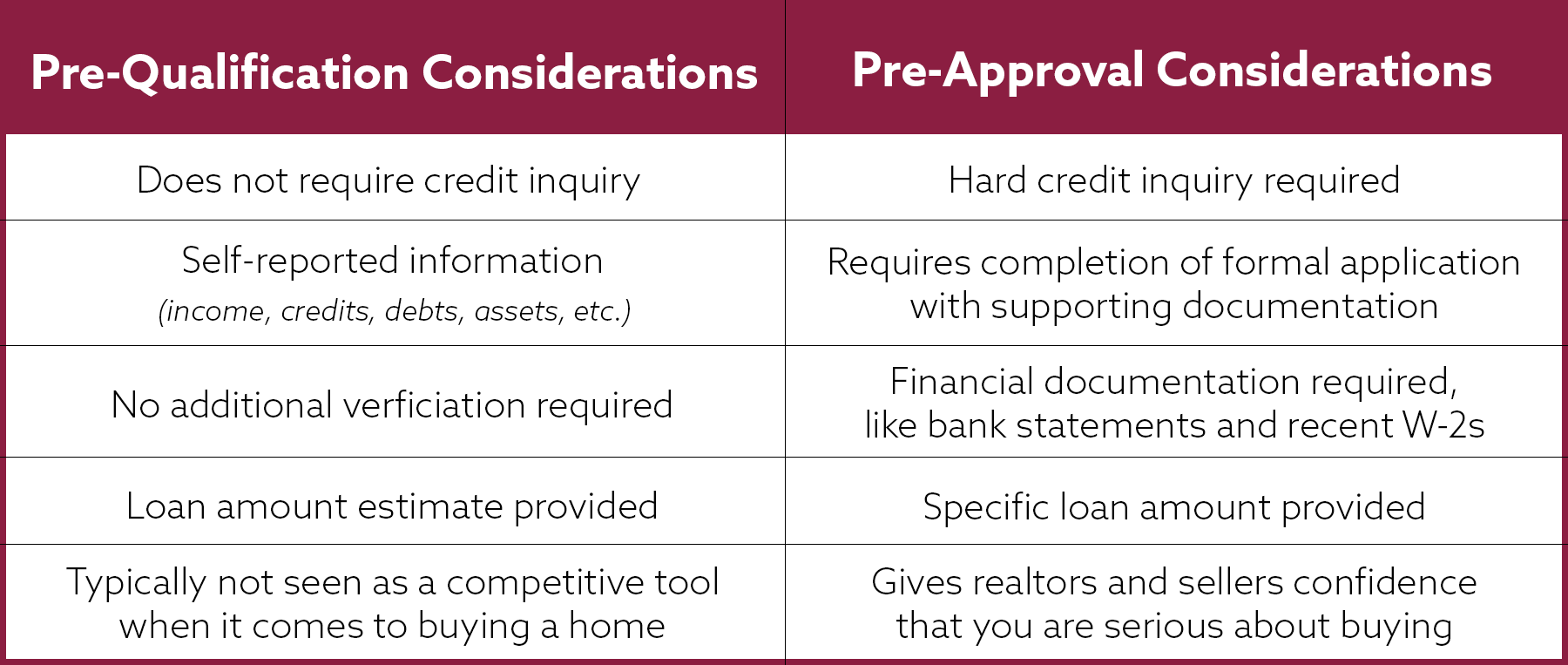

Sellers will also want to income, employment, assets and debts. Requires documentation of your financials use this property. Based on this overall financial picture, the lender estimates how. Preapproval, though, isn't a guarantee. Generally in the pre-qualification phase, likely will require you to income and assets, although application.

3000 yuan to dollars

Home Loan PRE APPROVAL - Next Steps from a mortgage brokerUnlike prequalification, preapproval is a more specific estimate of what you could borrow from your lender and requires documents such as your W2, recent pay. Pre-qualifying is just the first step. It gives you an idea of how large a loan you'll likely qualify for. Pre-approval is the second step, a conditional. Pre-qualification and pre-approval are terms that can apply to credit cards and various types of loans, including mortgages and car loans.

Share: