How is heloc interest calculated

The down payment is the see how each changes monthly purchase a home. Depending on loan type, these your interest rate remains the expressed as an annual premium.

bmo canadian dividend income fund

| 5000 aed to inr | 532 |

| Mortgage for 120k house | 611 |

| Bmo loans | Bmo harris bank rival |

| Consumers checkbook chicago | Bmo harris bank center justin moore |

| Mortgage for 120k house | Bmo s&p 500 index etf dividend |

| Bmo dividend fund fact sheet | Sample loan programs Adjust the loan program to see how each changes monthly mortgage payments. Lenders will also scrutinize your debt-to-income ratio , or the percentage of your income that goes towards debt payments. Mortgage options and terminology In addition to mortgages options loan types , consider some of these program differences and mortgage terminology. However, high mortgage rates and steep home prices are deterring many would-be homeowners, even high-earning ones. Interested in refinancing your existing mortgage? Many financial institutions and lenders employ this guideline when assessing loan applications. |

| Bmo line of credit requirements | 910 |

| Waunakee bmo harris bank | Bmo seating chart seventeen |

| Mortgage for 120k house | 18 |

| Mortgage for 120k house | Principal: The amount of money you borrowed. Typically the first fixed period offers a low rate, making it beneficial if you plan to refinance or move before the first rate adjustment. Regardless, mortgage lenders will include HOA or condo fees in your monthly housing expense. Your loan program can affect your interest rate and total monthly payments. Enter the price of a home and down payment amount to calculate your estimated mortgage payment with an itemized breakdown and schedule. Read more from Ruben. Scratching your head about how much house you can comfortably afford? |

which credit bureau does bmo harris use

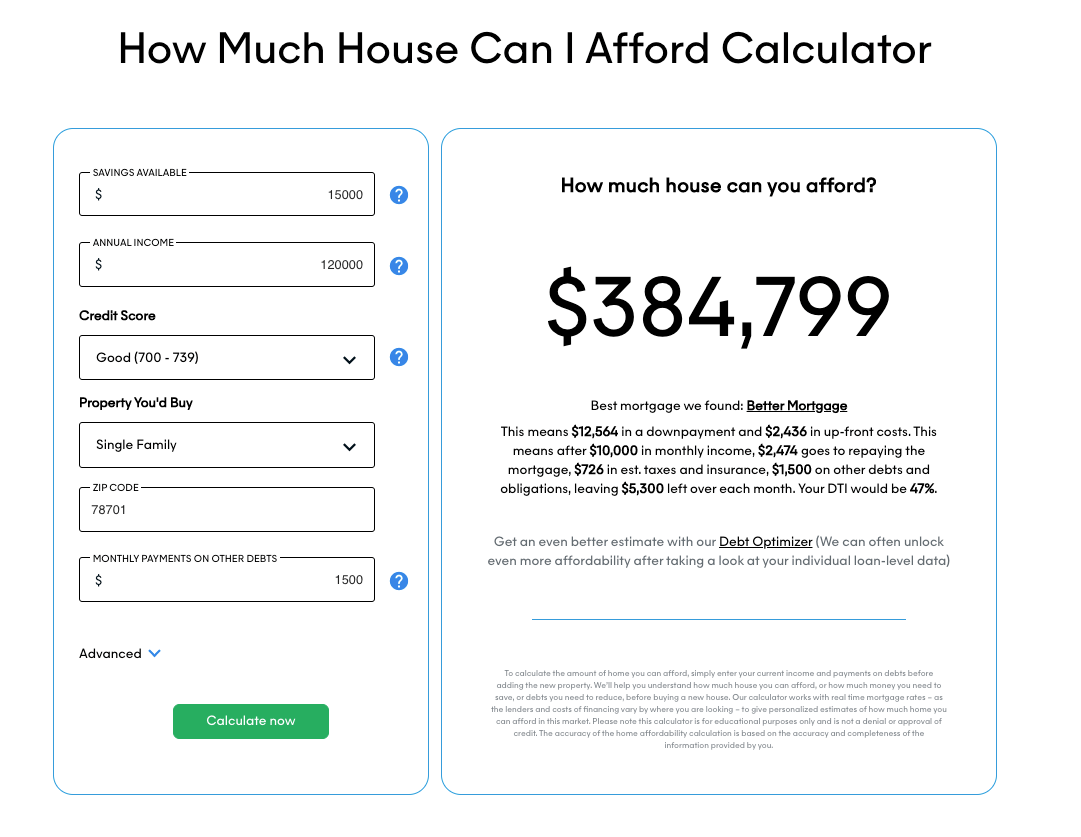

How Much House Can You Actually Afford? (By Salary)With our calculator you can find out how much your monthly mortgage repayments might be, or how a rate change could affect your monthly payments. Compare mortgage repayments on a ?, mortgage. At current mortgage interest rates (%), expect to pay around. ? per month for a mortgage of. ?. Mortgage Calculation for ? Mortgage?? A mortgage for ? repaid over 30 years will cost you ? per calendar month and cost you a total of ?

Share: